Real-time project application and approval

1. Initiated by branch office: firstly to be approved by branch office: internal approver of branch office, liaison of branch office, review by liaison of branch office, manager of branch office, approval by manager of branch office, and then to be approved by head office; 2. Initiated by head office: to be directly approved by head office: PM of head office, determine whether the project needs to be approved by branch office, if yes the project is sent to branch office for approval and then returned to head office for approval, if not the project is to be approved by head office: manager of card center, department countersign, PM of head office (summary), review by PM of head office.

Annual fee waiver approval process for a single/ a batch of high-end card(s)

1. Initiated by branch office: firstly to be approved by branch office: internal approver of branch office, liaison of branch office, review by branch office, manager of branch office, approval by manager of branch office, and then to be approved by head office; 2. Initiated by head office: to be directly approved by head office: PM of head office, determine whether it needs to be approved by branch office, if yes it is sent to branch office for approval and then returned to head office for approval, if not it is to be approved by head office: review by PM of head office, manager of card center, manager of card center, PM of head office (summary), review by PM of head office(summary), account reconciliation(based on actual circumstances).

Credit card approval process

1. Initiator: no restriction, can be initiated by any operator with access or new authorization. 2. Department manager: approver in the system "manager of each department". 3. Countersign: operator may select the counter-signature personnel. 4. Person in charge, clerk, line manager, operator: self-created parameterized roles, with customizable parameters as unique identification marks.

Comprehensive financial services/structured deposit/client access

1. Marketing opinion for comprehensive financial services: to be approved by branch office, four departments of branch office countersign; to be approved by head office, four departments countersign. 2. Application for customized structured deposit products: to be approved by branch office, two departments of branch office countersign; to be approved by head office, two departments countersign; to be approved by head office, no approval by president is required. 3. Corporate client access: to be approved by branch office and head office, no countersignature is required.

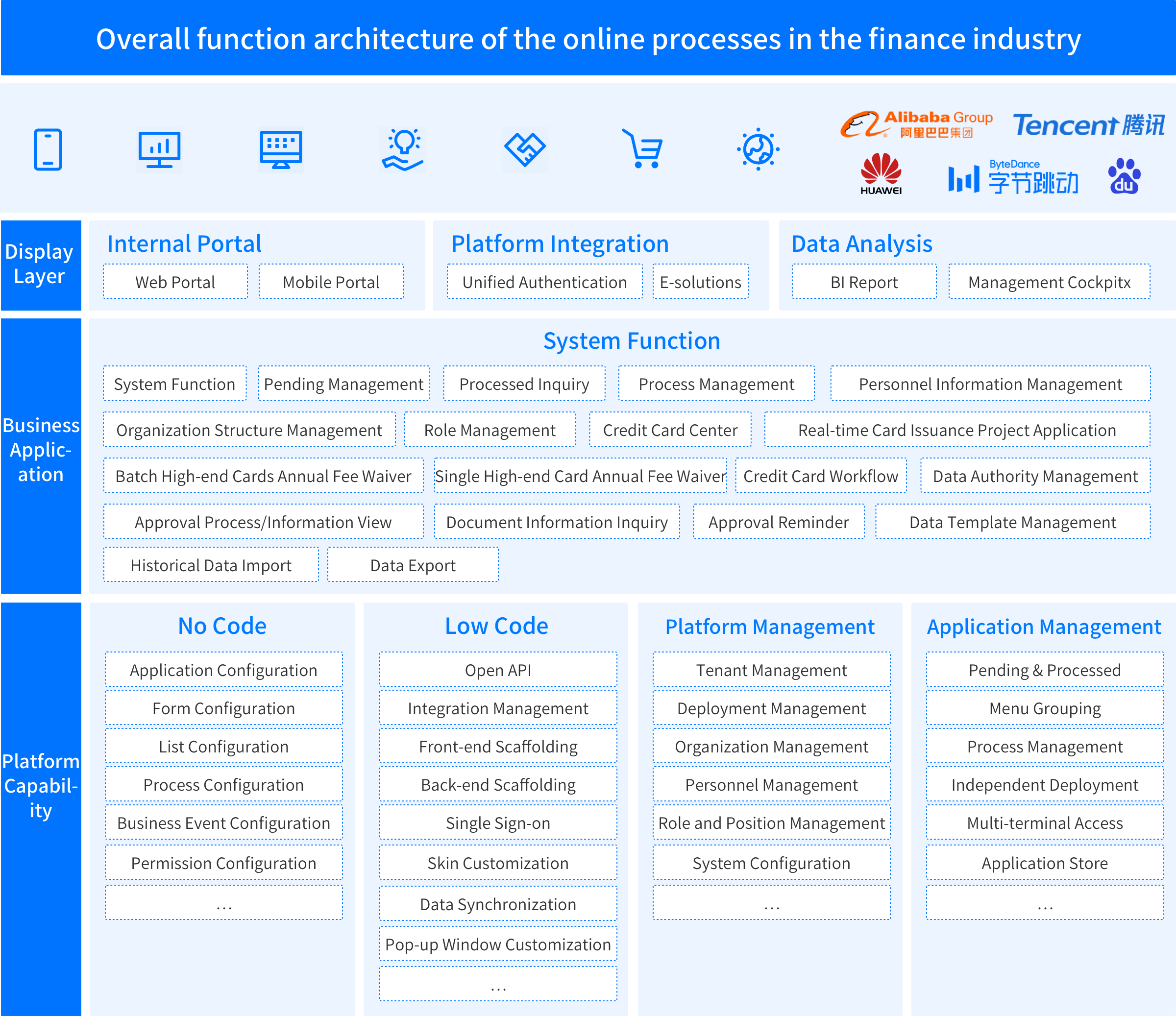

Business application enrichment

Update IT system, add digital business documents and business process application scenarios, realize online submission of documents, intelligent approval process and standardized management system.

Process traceability visualization

Business approval in the system is traceable. The status and process of approval and be checked in real time.

Intensive data management

Create multi-source data connection channels, record and manage data online, monitor and analyze data in real time.

Collaborative business communication

Fill in documents online to reduce paper waste and enterprise costs. Realize collaboration and reduce time cost through online management.

80%

improvement in data entry efficiency

70%

improvement in review process efficiency

100%

online auto-filling upgrade from manual filling